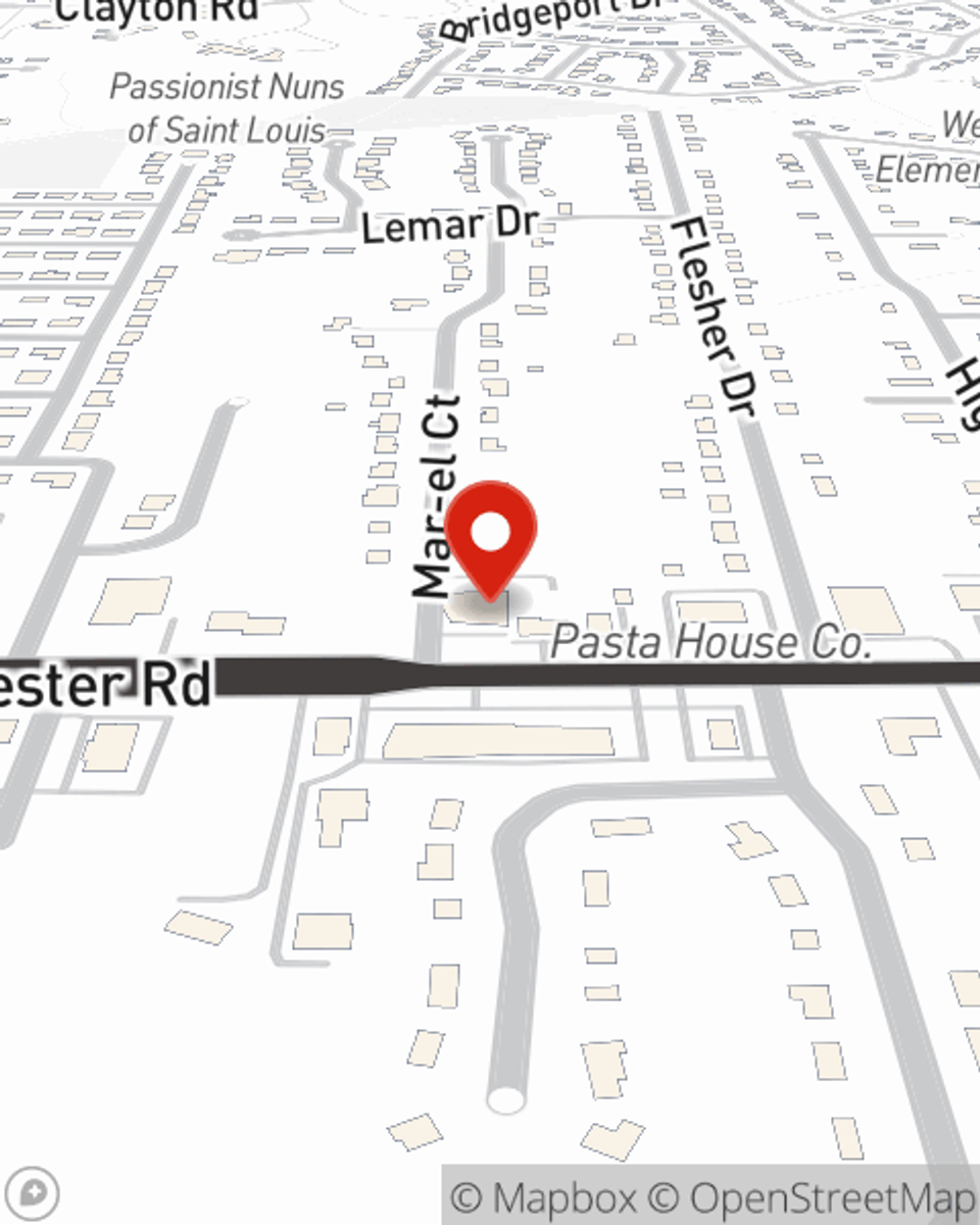

Business Insurance in and around Ellisville

One of Ellisville’s top choices for small business insurance.

No funny business here

- Ballwin

- Chesterfield

- Wildwood

- Town and Country

- Manchester

- Clarkson Valley

- Valley Park

- Eureka

- Weldon Spring

- Fenton

- Kirkwood

- Des Peres

- Sunset Hills

- High Ridge

- Pacific

- Frontenac

- Saint Louis County

- Saint Charles County

- Jefferson County

State Farm Understands Small Businesses.

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Lincoln Elbe. Lincoln Elbe can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of Ellisville’s top choices for small business insurance.

No funny business here

Protect Your Future With State Farm

For your small business, whether it's a bridal shop, a candy shop, a drug store, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like loss of income, business property, and buildings you own.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Lincoln Elbe's team today to get started.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Lincoln Elbe

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.